Josh Bullard, from our our Smart Energy team, writes about how Hydrock has addressed a gap in the energy market: that of an informed consultant who understands the changing energy landscape, who can bring competition to the appointment of energy providers, enabling clients to maximise the available returns from their site.

The National Grid has always struggled with surges in demand. We now face further challenges. With the increasing amount of wind and solar power, peaks in surplus supply need to be managed. At the same time, demand has never been so changeable. Just take increased levels of electrification, most notably vehicle charging, and the impact this has on infrastructure, capacity and resilience – all require urgent attention.

Keeping the lights on

In every challenge there is opportunity. Enter, specialist energy suppliers who offer people and organisations with land assets an opportunity to access cheaper, cleaner and more reliable energy, and the additional opportunity to benefit from local energy trading and smart tariffs, resulting in an income generating tradeable asset.

The government holds capacity auctions in a bid to smooth out the dips and blips in energy supply. Specialist energy suppliers bid to supply and, having won the auction and with a contract in place, then require opportunities to connect to the grid and provide what is essentially a power reservoir.

For the developer this means 25% return on capital employed (ROCE) with an investment valuation on 4% yield. In the current financial market this is a unique opportunity.

Developing opportunity

As a developer of a reasonable sized masterplan, bringing new power to the site can often be a costly and programme-limiting affair. Astronomical budgets and programmes running into many years are far from unheard of, with utility supplies often causing significant constraints to developments.

But what if a specialist energy supplier was willing to take this hassle away, potentially at zero cost to the developer?

With the appropriate engineering know-how, smart energy suppliers and developers can create power connections to sites at zero cost to the developer and with energy supplied to the future tenants below typical market tariffs.

Journey’s start

A private ‘behind-the-meter’ power network enables the use of batteries for storing power when it is cheap and the ability to supply power back to the grid when the rate is high. Hydrogen fuel cells also do the same, but on a bigger scale. Inter-development trading of power between building-mounted PV arrays, building battery banks and EV batteries, all enabled by a development-wide smart-grid, maximise the value of every kilowatt hour. Storage technologies provide a further benefit of increased resilience for the site, reducing risk of intermittency of power or energy supply. Each of these technologies is an opportunity to monetise the future unpredictable nature of our national grid.

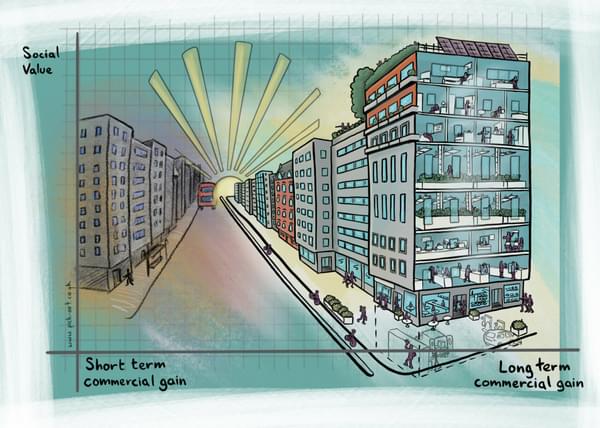

The unique part of this approach is to help balance the network at times of under or over demand which in turn can lead to a revenue stream for the land developer or landowner. This could potentially lead to contribution from the distribution network operator due to reduction of grid reinforcement. The economic benefits in operational terms are significant with a long-term revenue stream for the developer or landowner.

Beyond economics

To provide a further string to the bow, whilst the commercial case feels almost too good to be true, once we add heat demand, generation and storage to the mix, which is then used directly on site, distribution losses from long power lines are omitted and the overall installation results in lower carbon emissions than a traditional utilities connection approach. The resulting benefits are economic and environmental, helping to meet planning policy objectives and national carbon reduction requirements.

Once installed and running, the energy centre becomes a highly valuable tradeable asset even allowing for setting price points under market rates for heat and power sale to residents or tenants. This leads to further societal benefits including reduction of heat and fuel poverty.

How might this look in practice?

Every development is unique, and every developer has a different attitude to risk. As with any opportunity there are a plethora of funding arrangement ranging from low risk/low reward to high risk/high reward.

Options include programmes where the developer pays, installs and operates through to fully funded options provided by third parties with the developer still benefiting through reduced capital expenditure, energy costs and risk. On an overall risk/reward basis it has been some time since we’ve seen such a solid opportunity.

How can Hydrock help?

We're currently advising a developer who is conducting due diligence on a mixed-use, residential-led development, where we are assessing how they can use their building services assets more efficiently through battery storage to create further economic revenue.

In another example, we're advising an affordable housing provider on how to assess the most efficient deployment of technologies across a site and the delivery mechanisms that are available.

This Smart Energy service from Hydrock navigates clients through the constantly changing energy landscape, enabling clients to maximise the available returns from their site.

From developers to landowners, local authorities to asset managers, we work with clients to help understand the options and bring competition to the appointment of a provider. We help clients consider distributed generation, demand-side response, behind-the-meter generation, energy storage and capacity trading. Hosting an energy project really is a great way to realise additional value from an estate.

Contact Hydrock's Smart Energy team today.

A version of this article was originally published in PlaceTech.